Our Story

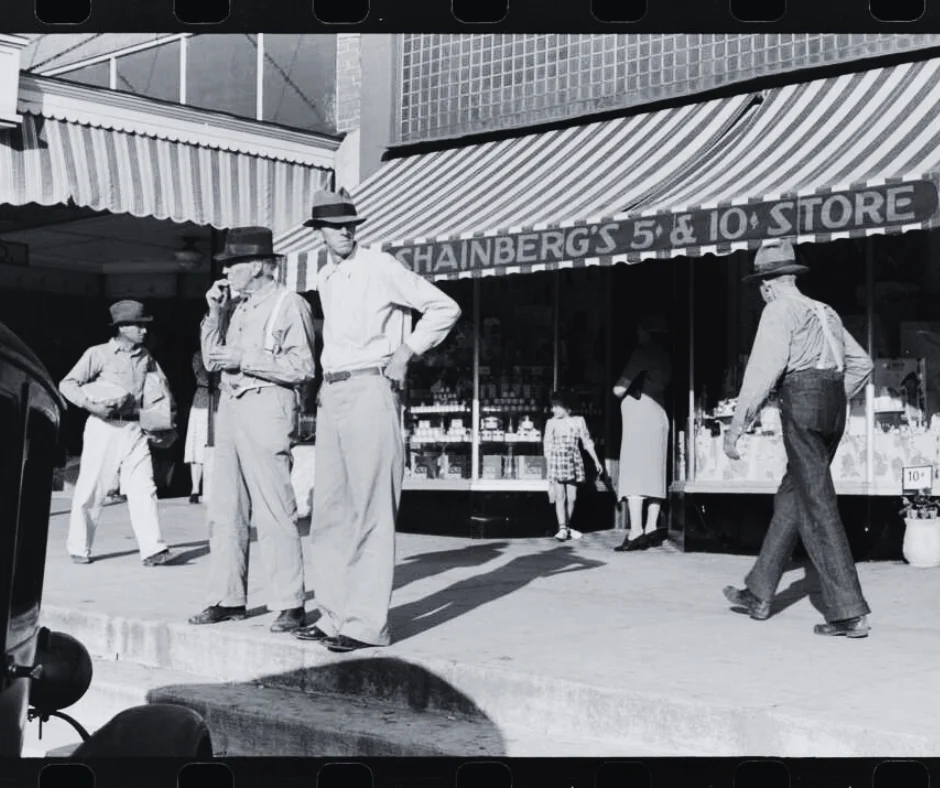

1936

Tower Loan opens and experiences prosperity and growth. The consumer finance industry was in it's infancy.

1945

After World War II, Tower sold its offices to various employees within the company. The Jackson, Mississippi, South State Street Office of the original Tower group was purchased by Ed and Kate Clark. Under the Clarks' ownership, Tower Loan brokers grew from a single office to 16 offices throughout Mississippi.

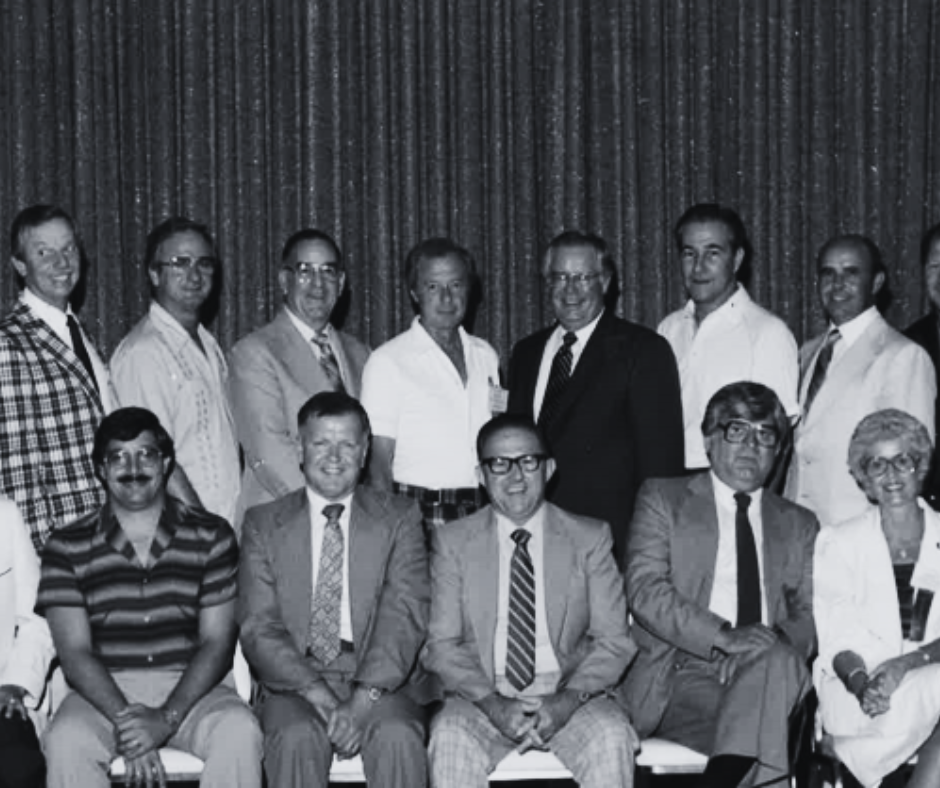

1972

Following the death of Kate Clark, Jack Lee purchased 12 of Ed Clark's offices. The 4 offices not purchased were sold to managers within Clark's company and are still operating today. The offices purchased by Jack Lee were located in North Jackson, Clinton, East Jackson, Yazoo City, Canton, Kosciusko, Pascagoula, Louisville, Eupora, Carthage, Moss Point, and Philadelphia. In later years, the Moss Point office was merged into Pascagoula, Clinton was moved to Southwest Jackson, and East Jackson was moved to Pearl. Some of these offices operated as Tower Loan, and some operated as Russell Baker Finance.

1983

To provide credit-related insurance, Tower established two insurance companies: American Federated Life Insurance Company, specializing in credit life and credit accident and health insurance, and American Federated Insurance Company, focusing on credit property insurance. Tower's parent corporation now owns both companies. Through strategic openings and acquisitions, Tower expanded to 29 offices across Mississippi, becoming the state's largest consumer finance company.

1990

Tower Loan made its largest acquisition to date with the purchase of Louisiana-based Reliable Finance Company, expanding its lending operations into 13 offices across Louisiana. At that time, the only remaining Russell Baker Finance office was in Vicksburg, Mississippi, which was rebranded as Reliable Finance before the acquisition. To consolidate its growing structure, Tower formed First Tower Corp., a holding company encompassing Tower Loan of Mississippi, Inc.; American Federated Life Insurance Company; and American Federated Insurance Company. Reliable Finance Company was later rebranded as First Tower Loan, Inc. and became part of the First Tower Corp. umbrella.

1992

Tower Loan acquired the nine consumer loan offices of Eagle Federal Savings Bank, bringing its total to 60 offices.

1997

Tower purchased the four offices of Walthall Finance and later purchased the eight offices of Money Mart, Inc.

1999

Tower Loan significantly expanded its footprint by acquiring the receivables of Gulfco Finance Company, based in Marksville, Louisiana, increasing the company's size by nearly 50%. This strategic acquisition included certain assets from specific Gulfco Finance offices, resulting in 21 new locations and marking Tower's largest single acquisition to date.

2004

Tower acquired the remaining Mississippi receivables of Tico Finance Company and Personal Finance Company.

2006

Tower expands operations into the state of Missouri by opening 8 offices. As of 2013, Tower has 38 offices in Missouri.

2013

Tower expands operations into the state of Illinois and Alabama, opening four offices in Alabama and eight offices in Illinois.

2018

Tower made its largest acquisition in company history, Harrison Finance Company.

2021

Tower expands into Texas with three new offices.

2025

Tower Loan expanded its footprint into Florida and Tennessee, marking a significant milestone in the company’s growth. With a network of over 260 locations and more than 1,000 dedicated employees, this expansion reflects our ongoing commitment to providing exceptional service and tailored financial solutions. As we enter new communities, we continue to strengthen local connections, offer accessible lending options, and uphold our reputation as a trusted leader in consumer finance.